General Insurance Advice

Understanding your insurance excesses

Understanding insurance excesses is important, so that a policy which seems cheap on the face of it doesn’t end up costing you a lot more than you expected.

The boffins are on the case…

What is an insurance excess?

The excess is the first part of every claim that you must cover yourself, before your insurer steps in.

If you have a £100 excess and are making a claim worth £1,000, your insurer pays £900.

Compulsory versus voluntary

As well as the compulsory excess an insurer has on every policy, you can also agree to an additional voluntary excess to reduce the cost of your premium.

If you have a £100 compulsory excess and a £100 voluntary excess and make a claim worth £1,000, your insurer pays £800.

Useful information:

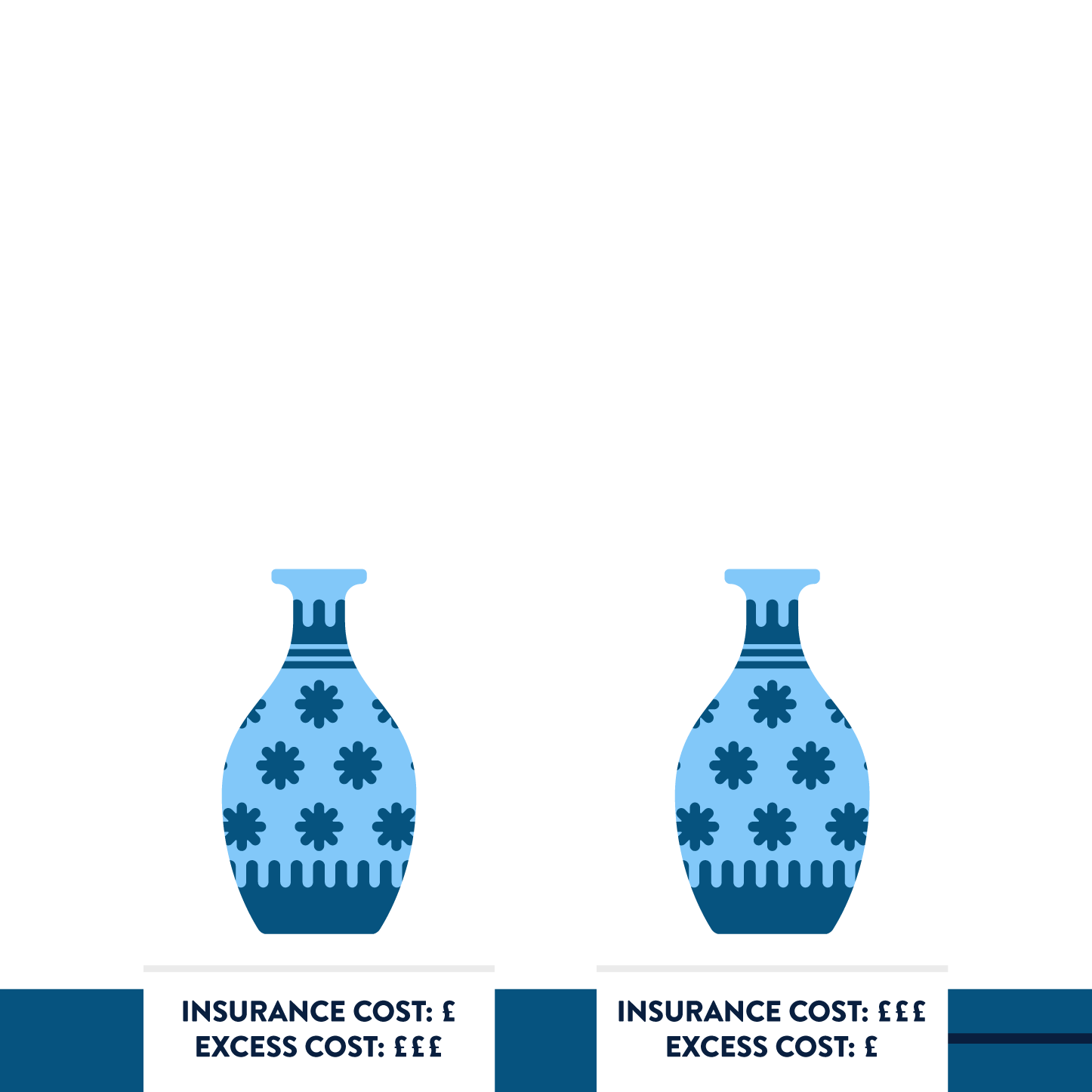

Doing the maths

Sometimes a policy will look cheaper because it comes with higher excesses, so don’t forget to compare these numbers as well as the cover being offered when you’re setting up a policy.

Agreeing to a higher excess can be one way of making savings on your premium but it is important to think about what this would mean if you needed to make a claim. Could you afford to pay the higher excess you’re agreeing to if something happened to your car or home?

Could you afford to pay a higher excess?