Property Insurance

Are you insured for the right amount?

It is important that you insure your buildings and contents for the right amount. This value is one of the things used to calculate your premium and if the sum insured is wrong, you may only get some of your pay out if you need to make a claim.

Here’s what we found in the laboratory…

Is your building insured

for the right amount?

Your insurer needs to know the rebuild cost of your property. That’s the cost to demolish it and then get it completely back to normal, using various professionals such as architects.

To help you work out what value to cover, some insurers will make a calculation for you or offer a standard limit for a typical property. For others, there is an online tool you can use to work it out.

Useful Information:

Is your home a standard build?

If your home is not standard construction, for example if it is listed, historical or a thatched property, then you may need to ask a surveyor to work out the rebuilding cost.

The Royal Institute of Chartered Surveyors can help you find a suitable surveyor to assess your property.

Always remember!

If you make any significant changes to your home, such as adding an extension, always let your insurer know. Its always best to cover your own back!

Our helpful hints: Getting

your contents limit right

Your contents should be insured for the cost of replacing them as new, not their current value. It is important to check you’re insured for the right amount on a regular basis, particularly after purchasing expensive items, or following a birthday or Christmas.

Often contents policies will have a limit so check that this is high enough to cover all your belongings.

You could do an inventory

When you start adding everything up, your total contents value may surprise you.

Don’t forget books, DVDs and all your clothes too. There are apps which can help you do an inventory of your home, and photographs of your belongings will be helpful if you need to make a claim.

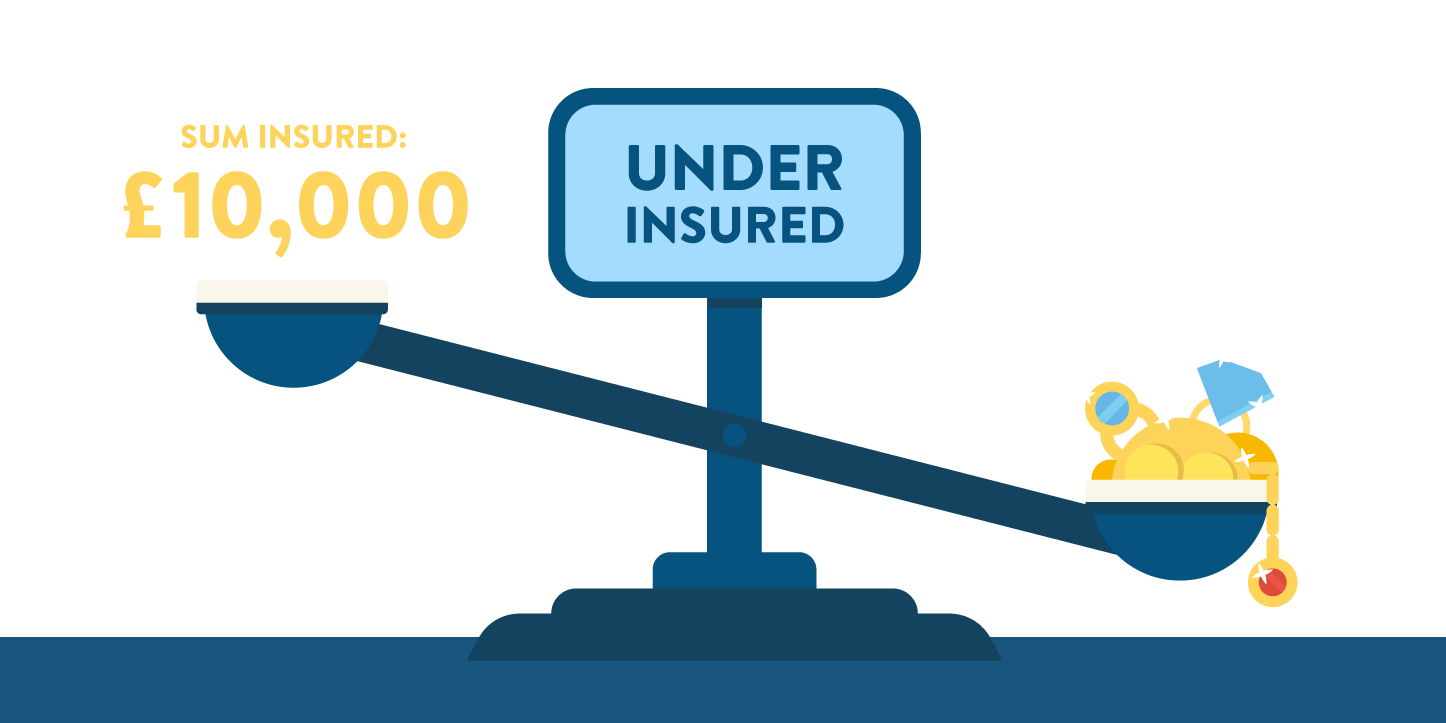

Under-insured? No thanks!

Being under-insured can mean you only get some of the pay out you’re expecting if you need to make a claim. Your insurers are there to help you, so ask them if you need any information or advice.