Property Insurance

Home insurance isn’t a maintenance contract

You have a responsibility to look after your property. If you’ve not maintained it properly and this leads to more serious damage, our lab results show you might not get a full pay out.

Here are some helpful tips from our scientists to make sure you are always covered.

Insurance facts:

Keeping up appearances

Insurance doesn’t cover you for normal wear and tear to your building. It’s there to help when the unexpected happens.

There are some very common claims made that can be easily avoided by simply making regular checks for signs of wear and tear. Blocked drains and loose roof tiles can cause major leaks and floods.

Useful insurance tips:

DIY or getting an expert?

If you are handy with a hammer and spanner, then there’s nothing wrong with doing your household maintenance yourself. Remember DIY accidents do happen, so you might want to check you have accidental damage cover in place just in case!

There are some jobs that might need a trained professional. And if something does happen to your property, it can be useful to be able to tell your insurer who did the work and when.

Did you know?

Flat-roofs have a short lifespan (around 10-years) and need to be inspected by a roofing professional to make sure they’re up to scratch. If you spot uneven lumps on your flat roof, get it checked!

Useful Facts: Storm's a-brewin’

Many policyholders try to claim for roof tiles that have fallen off their houses, but insurance only covers you for this when it’s caused by a storm.

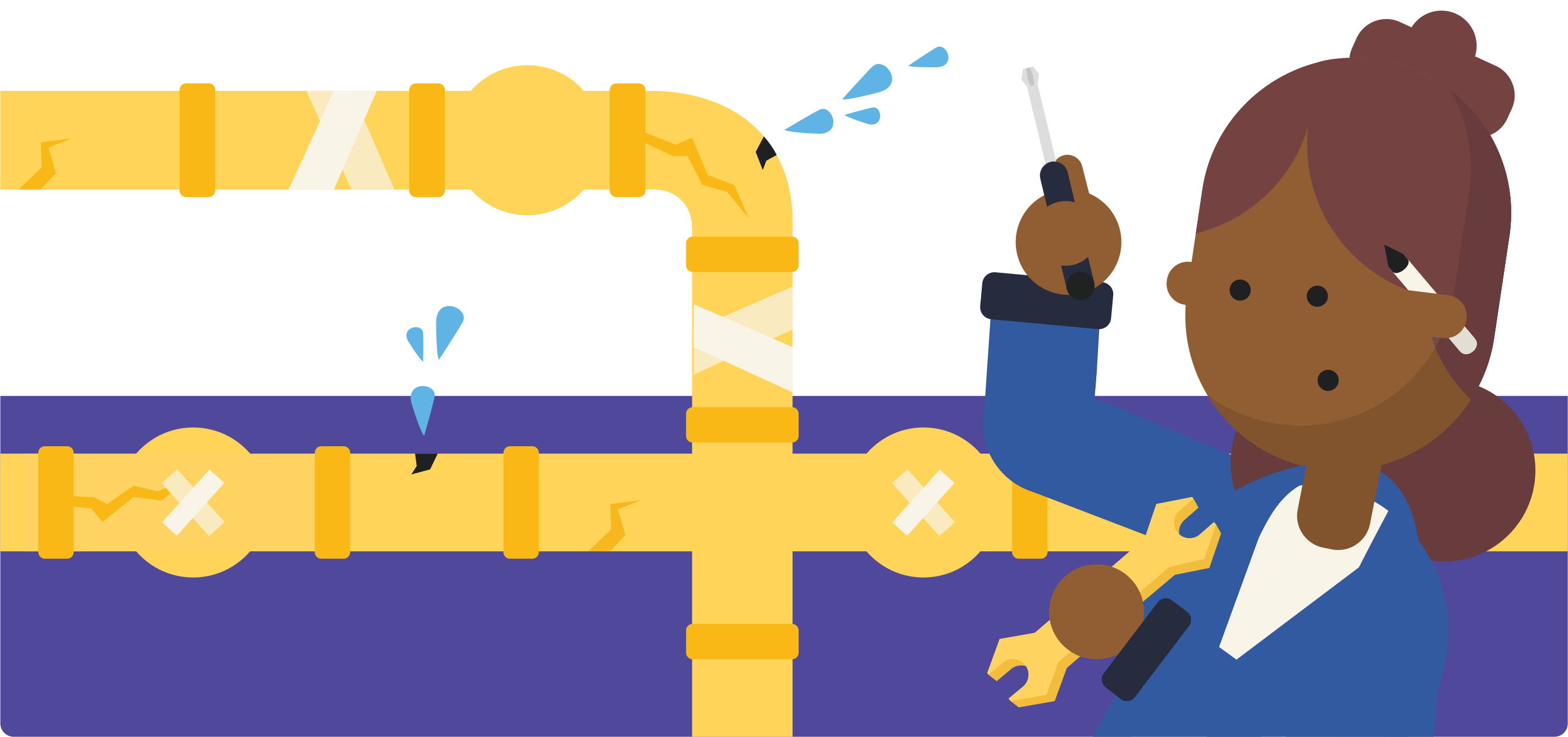

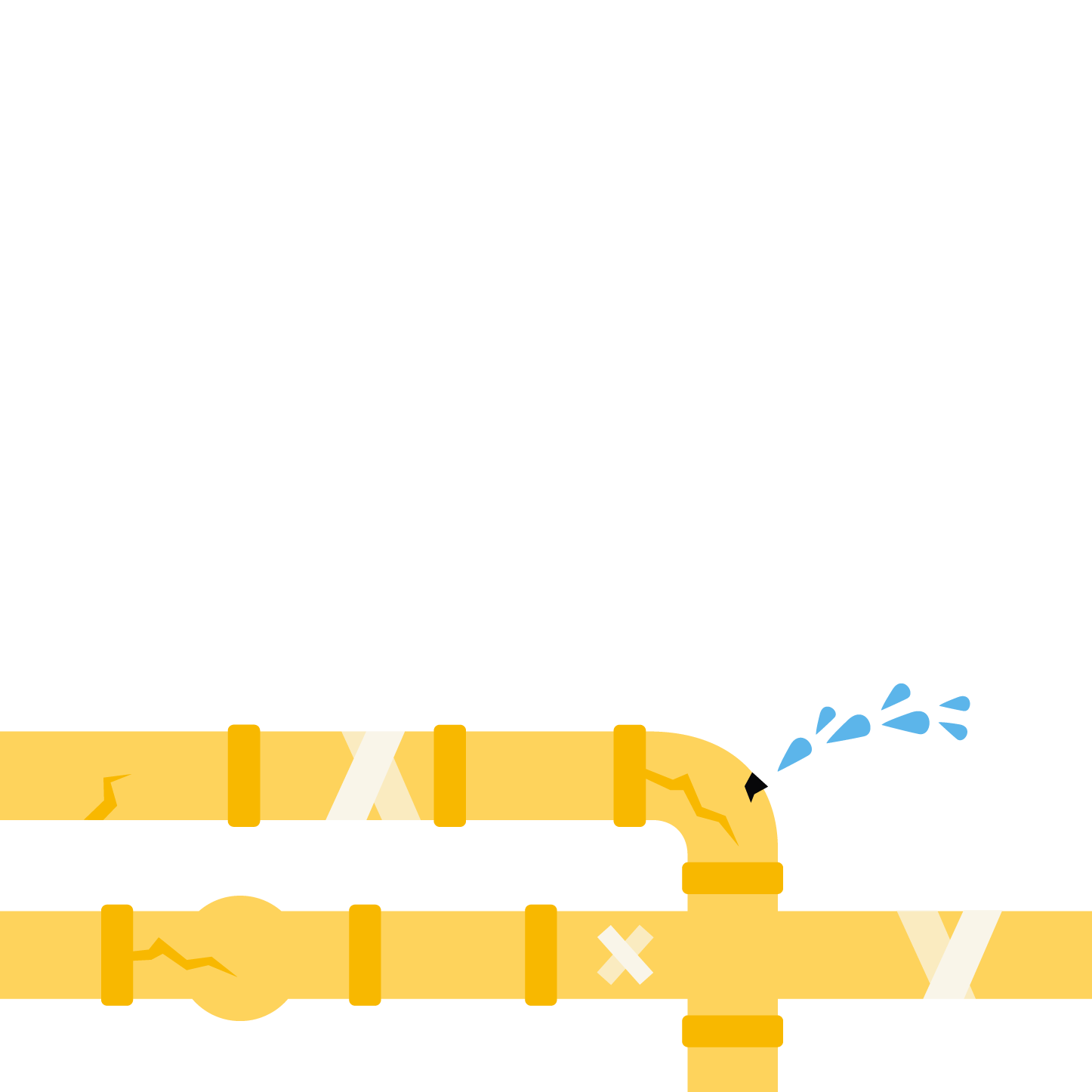

See a leak in your home?

If you see a damp patch forming on your wall or ceiling, or just notice a pipe dripping, it’s always a sign that something needs investigating ASAP. You may need to call an emergency contractor to get it fixed.

If it’s likely you’ll need to make an insurance claim, tell your insurer as soon as possible.