Car Insurance

The effects of age on motor insurance

It’s often the case that if you’re young, your car insurance will be more expensive than for other people. Much older drivers can also see higher premiums.

But how does your age effect your car insurance? The boffins are on the case…

Simple statistics: Age old tales

Insurers decide how much you pay for your motor insurance depending on how likely it is you’ll need to make a claim, particularly for a large amount. Age is a big clue to this.

The reason is simple statistics. Based on years and years of data, insurers can predict how much certain age-groups are likely to cost them in claims.

0

Average claim value made by 18-20 year olds (they claim more often too).

0

Average claim value made by 60-65 year olds (the safest age group).

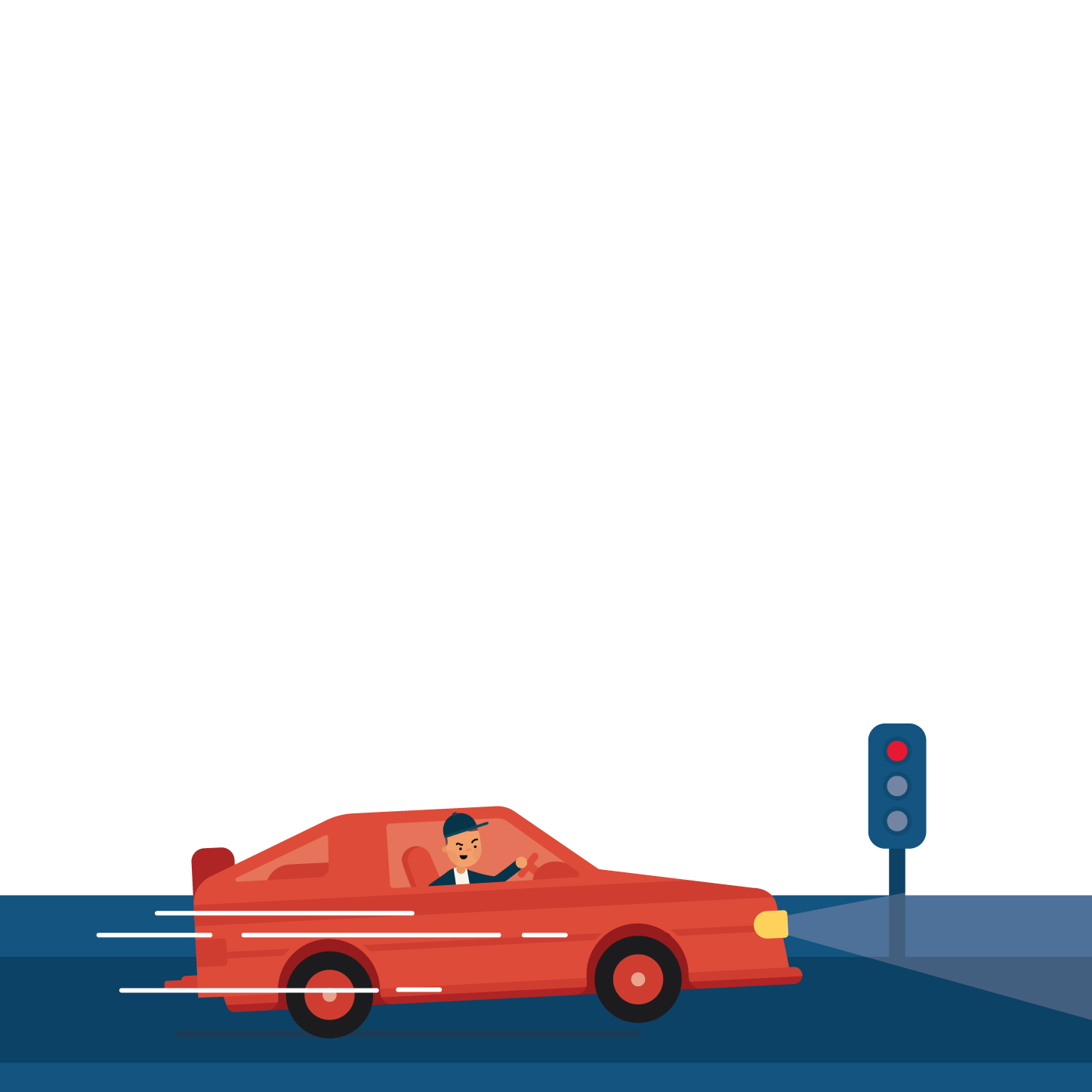

Young drivers

Young drivers haven’t had the chance to build up experience on the roads. A scary fact is that 1 in 5 young drivers will be involved in a car crash within six-months of passing their test.

It’s also the case that young drivers are more likely to have the worst type of crashes, where a number of people in the same car all suffer really severe injuries and need special care for many years.

Older drivers

Experience isn’t the answer to everything. Insurers’ statistics also show that after the age of 71 drivers become more likely to have accidents and again, they are accidents which are more likely to result in really serious injuries.

This issue gets worse as drivers get older. Drivers who are over 91 have average claims costing nearly the same as the claims made by 18 to 20 year olds.

Useful tips on saving money

The motor insurance industry is very competitive, so it’s always worth shopping around when renewing your policy. Other things which can help save money:

- Think about the type of vehicle you have. Low power ones will be cheaper to insure.

- Get a telematics policy, also known as black box insurance. This measures how you drive and will give you a discount if you can prove you’re safer than average.

- Use a specialist insurer or broker to help hunt out the best deal for you.

The best years of your life

The age group which tends to pay the lowest motor premiums are people in their 60s, paying around a quarter of what the youngest drivers may have to pay. This is helped by the fact they are often able to build up a no claims discount.